Insuring Your Ride: The Importance of Vehicle Insurance

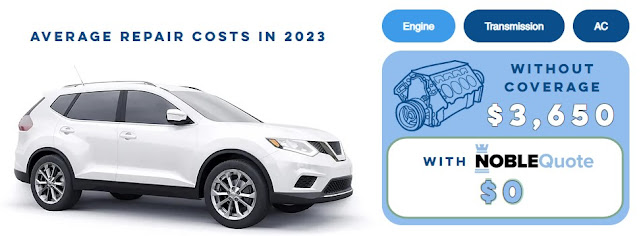

Vehicle insurance, also known as auto insurance or car insurance, is a contract between a policyholder and an insurance company that provides financial protection in the event of an accident or other covered loss involving the policyholder's vehicle. In exchange for a premium, the insurance company agrees to cover the cost of damage to the policyholder's vehicle, as well as liability for any injuries or property damage that the policyholder may cause to others while driving. However, websites like Noble Quote offer best coverage plans.

Vehicle insurance policies typically include several types of coverage, such as:

Liability Coverage: This covers the cost of damage or injuries that the policyholder may cause to others in an accident for which they are found to be at fault.

Collision Coverage: This covers the cost of damage to the policyholder's vehicle in the event of a collision with another vehicle or object.

Comprehensive Coverage: This covers the cost of damage to the policyholder's vehicle from non-collision events, such as theft, vandalism, or natural disasters.

Personal Injury Protection (PIP) Coverage: This covers medical expenses and lost wages for the policyholder and passengers in the event of an accident, regardless of who is at fault.

Vehicle insurance is important because it provides financial protection and peace of mind while driving, and it is often a legal requirement in many countries.

Choosing a reputable company for vehicle insurance is important for several reasons:

Financial Stability: Reputable insurance companies are financially stable and have a strong track record of paying out claims in a timely and fair manner. This means that you can rely on them to provide the coverage you need in the event of an accident or other covered loss.

Quality Customer Service: Reputable insurance companies also typically provide high-quality customer service, which can be crucial when you need to file a claim or have questions about your coverage. They should have a customer service team available to assist you and handle your concerns quickly and efficiently.

Comprehensive Coverage Options: A reputable insurance company will offer a range of coverage options that can be customized to fit your specific needs and budget. This allows you to choose the coverage that is right for you and your vehicle.

Trustworthy Reputation: Choosing a reputable insurance company with a trustworthy reputation can give you peace of mind that you are working with a company that has a good track record of serving its customers and honoring its commitments.

Overall, choosing a reputable insurance company for your vehicle insurance is important for ensuring that you have the financial protection and customer service support you need when you need it most. However, Noble Quote are fulfilling your needs.

Comments

Post a Comment